Digital Trade Insights Q4 2025

In our latest quarterly issue: Documentary trade finance as a critical tool for mitigating payment & compliance risk amid tariff and geopolitical uncertainty; paperless trade momentum continues to accelerate as governments and industry bodies advance MLETR‑aligned frameworks recognizing digital negotiable instruments; the emerging role of AI and data standards in enabling efficient, interoperable and inclusive trade; trade finance banks embrace cross-platform eBL interoperability — plus much more! + SUBSCRIBE

Industry News & Views

UN General Assembly Adopts Breakthrough Convention on Cargo Documents to Facilitate Global Trade: Adopting the UN Convention on Negotiable Cargo Documents, a landmark treaty enabling goods carried by road, rail, air, or sea to be represented by a single negotiable document – in paper or electronic form (source: UN).

UN General Assembly Adopts Breakthrough Convention on Cargo Documents to Facilitate Global Trade: Adopting the UN Convention on Negotiable Cargo Documents, a landmark treaty enabling goods carried by road, rail, air, or sea to be represented by a single negotiable document – in paper or electronic form (source: UN).

WTO-ICC business survey sheds light on opportunities and challenges for AI use in trade: The survey – which gathers responses from 158 firms of varying sizes across diverse industries, regions and levels of economic development – highlights AI's potential to foster more inclusive global trade, underscoring the need to address gaps in AI adoption (source: WTO).

WTO-ICC business survey sheds light on opportunities and challenges for AI use in trade: The survey – which gathers responses from 158 firms of varying sizes across diverse industries, regions and levels of economic development – highlights AI's potential to foster more inclusive global trade, underscoring the need to address gaps in AI adoption (source: WTO).

Global trade to hit record $35 trillion despite slowing momentum: According to UNCTAD's year-end 2025 update, global trade is set to surpass $35 trillion in 2025 – growing 7% year‑on‑year – despite slowing momentum expected in 2026 due to rising debt, higher trade costs and continued uncertainty (source: UNCTAD).

Global trade to hit record $35 trillion despite slowing momentum: According to UNCTAD's year-end 2025 update, global trade is set to surpass $35 trillion in 2025 – growing 7% year‑on‑year – despite slowing momentum expected in 2026 due to rising debt, higher trade costs and continued uncertainty (source: UNCTAD).

Harmonised AI standards to reduce fragmented global rules: ICC policy paper highlights how divergent AI regulations across countries can lead to fragmented global markets and increased costs, calling for greater coordination towards developing global, market-driven AI standards that bridge legal & compliance burdens and improve market access (source: ICC WBO).

Harmonised AI standards to reduce fragmented global rules: ICC policy paper highlights how divergent AI regulations across countries can lead to fragmented global markets and increased costs, calling for greater coordination towards developing global, market-driven AI standards that bridge legal & compliance burdens and improve market access (source: ICC WBO).

Government of Hong Kong SAR launches industry consultation on proposed legislative amendments to facilitate digitalisation of B2B trade documents: The consultation aims to align with UNCITRAL’s MLETR provisions, enhance interoperability, reduce costs, increase efficiency, and strengthen Hong Kong's competitiveness in international trade (source: GovHK).

Government of Hong Kong SAR launches industry consultation on proposed legislative amendments to facilitate digitalisation of B2B trade documents: The consultation aims to align with UNCITRAL’s MLETR provisions, enhance interoperability, reduce costs, increase efficiency, and strengthen Hong Kong's competitiveness in international trade (source: GovHK).

Mitigating tariff risk with letters of credit (LCs): Exploring how letters of credit (LCs) are regaining importance as tariff volatility and geopolitical tensions rise, helping mitigate tariff‑driven payment and compliance risks by offering structured protection, clearer obligations, and stronger risk management for trade participants (source: ICC Academy).

Mitigating tariff risk with letters of credit (LCs): Exploring how letters of credit (LCs) are regaining importance as tariff volatility and geopolitical tensions rise, helping mitigate tariff‑driven payment and compliance risks by offering structured protection, clearer obligations, and stronger risk management for trade participants (source: ICC Academy).

Why trade finance fraud threatens global markets: Exploring why trade finance fraud continues to pose a global threat, with criminals exploiting the sector’s manual, paper based processes to forge bills of lading, invoices, and customs documents, often using advanced tools such as generative AI (source: FinTech Global).

Why trade finance fraud threatens global markets: Exploring why trade finance fraud continues to pose a global threat, with criminals exploiting the sector’s manual, paper based processes to forge bills of lading, invoices, and customs documents, often using advanced tools such as generative AI (source: FinTech Global).

VIDEO – Mining companies reflect on the 25 by 25 eBills of Lading campaign: BIMCO’s Grant Hunter speaks with BHP, Rio Tinto, Vale and Anglo American, as they each reflect on the success of the BIMCO-led eBL campaign – whose goal of using eBLs for at least 25% of annual seaborne volume by 2025 was surpassed a year ahead of schedule in iron ore trade (source: BIMCO).

VIDEO – Mining companies reflect on the 25 by 25 eBills of Lading campaign: BIMCO’s Grant Hunter speaks with BHP, Rio Tinto, Vale and Anglo American, as they each reflect on the success of the BIMCO-led eBL campaign – whose goal of using eBLs for at least 25% of annual seaborne volume by 2025 was surpassed a year ahead of schedule in iron ore trade (source: BIMCO).

Trafigura renews upsized eBL borrowing base: Trafigura has closed a $3.06 billion borrowing base facility, marking an upsized renewal of its landmark structure which pioneered the use of ICE CargoDocs eBLs as secured collateral in syndicated financing, attracting strong support from 29 participating banks (source: TXF).

Trafigura renews upsized eBL borrowing base: Trafigura has closed a $3.06 billion borrowing base facility, marking an upsized renewal of its landmark structure which pioneered the use of ICE CargoDocs eBLs as secured collateral in syndicated financing, attracting strong support from 29 participating banks (source: TXF).

A Comparison of UK and U.S. Regulatory Frameworks for Stablecoins: Highlighting how the divergence in scope, regulatory philosophy, and licensing requirements risks creating interoperability challenges, compliance friction, and potential barriers to global adoption and cross-border use of stablecoins (source: Morrison Foerster).

A Comparison of UK and U.S. Regulatory Frameworks for Stablecoins: Highlighting how the divergence in scope, regulatory philosophy, and licensing requirements risks creating interoperability challenges, compliance friction, and potential barriers to global adoption and cross-border use of stablecoins (source: Morrison Foerster).

Global financial community completes switch to ISO 20022, paving way for new levels of cross-border payment speed and innovation: According to Swift, universal adoption of the ISO 20022 standard – which fully replaces the MT message format – enables faster, more efficient and innovation-driven cross border payments, strengthening compliance and interoperability (source: Swift).

Global financial community completes switch to ISO 20022, paving way for new levels of cross-border payment speed and innovation: According to Swift, universal adoption of the ISO 20022 standard – which fully replaces the MT message format – enables faster, more efficient and innovation-driven cross border payments, strengthening compliance and interoperability (source: Swift).

Why URDTT matters now: Trade finance expert, Dave Meynell, on why the ICC Uniform Rules for Digital Trade Transactions (URDTT) are set to become essential, as trade gradually shifts from document-based workflows to data-driven digital ecosystems – underpinned by growing MLETR adoption, interoperability, and structured data standards (source: tradefinance.training).

Why URDTT matters now: Trade finance expert, Dave Meynell, on why the ICC Uniform Rules for Digital Trade Transactions (URDTT) are set to become essential, as trade gradually shifts from document-based workflows to data-driven digital ecosystems – underpinned by growing MLETR adoption, interoperability, and structured data standards (source: tradefinance.training).

ICC launches playbook to accelerate global paperless trade adoption: According to the ICC, the 'Paperless Trade Pilot Playbook' is aimed at helping governments and businesses implement digital trade systems, offering practical guidance in designing and executing paperless trade pilots that translate global frameworks into real-world progress (source: ICC WBO).

ICC launches playbook to accelerate global paperless trade adoption: According to the ICC, the 'Paperless Trade Pilot Playbook' is aimed at helping governments and businesses implement digital trade systems, offering practical guidance in designing and executing paperless trade pilots that translate global frameworks into real-world progress (source: ICC WBO).

Five topics that shaped trade finance in 2025: GTR’s 2025 review highlights a year defined by volatility in trade finance – from the sprawling First Brands fraud scandal to Trump’s renewed tariffs, turmoil in the UK non‑bank lending sector, and a surge in high‑stakes court disputes that reshaped risk across global markets (source: GTR).

Five topics that shaped trade finance in 2025: GTR’s 2025 review highlights a year defined by volatility in trade finance – from the sprawling First Brands fraud scandal to Trump’s renewed tariffs, turmoil in the UK non‑bank lending sector, and a surge in high‑stakes court disputes that reshaped risk across global markets (source: GTR).

BIMCO to launch new Maritime Digitalisation Network: An initiative designed to help accelerate the industry’s digital transformation, providing an open forum for stakeholders to share insights, collaborate on solutions, and explore areas like eBLs, voyage optimization, vessel tools and digital contracts (source: BIMCO).

BIMCO to launch new Maritime Digitalisation Network: An initiative designed to help accelerate the industry’s digital transformation, providing an open forum for stakeholders to share insights, collaborate on solutions, and explore areas like eBLs, voyage optimization, vessel tools and digital contracts (source: BIMCO).

DCSA releases universal API for arrival notices: Introducing a universal API to replace today’s manual processes for distributing arrival notices as PDFs by email, aimed at improving accuracy, automating receipt confirmation, reducing manual workload, and helping prevent costly disputes in import operations (source: Port Technology).

DCSA releases universal API for arrival notices: Introducing a universal API to replace today’s manual processes for distributing arrival notices as PDFs by email, aimed at improving accuracy, automating receipt confirmation, reducing manual workload, and helping prevent costly disputes in import operations (source: Port Technology).

Next-generation Trade Corridors: Building Digital Trade Superhighways: ICC UK report report identifies how connecting the world’s major trade finance & logistics hubs can unlock faster, cheaper and more sustainable trade – outlining practical steps needed to modernize trade corridors, establish interoperable systems, and phase out paper-based processes (source: ICC UK).

Next-generation Trade Corridors: Building Digital Trade Superhighways: ICC UK report report identifies how connecting the world’s major trade finance & logistics hubs can unlock faster, cheaper and more sustainable trade – outlining practical steps needed to modernize trade corridors, establish interoperable systems, and phase out paper-based processes (source: ICC UK).

ICE Digital Trade News

Driving Interoperability Forward: A Milestone for Digital Trade Finance: ICE Digital Trade, GSBN and IQAX have successfully enabled cross-platform electronic presentation of documents under an eUCP Letter of Credit. Find out why the live transaction, completed end December 2025, marks a major step towards scalable, interoperable digital trade & trade finance.

Driving Interoperability Forward: A Milestone for Digital Trade Finance: ICE Digital Trade, GSBN and IQAX have successfully enabled cross-platform electronic presentation of documents under an eUCP Letter of Credit. Find out why the live transaction, completed end December 2025, marks a major step towards scalable, interoperable digital trade & trade finance.

VIDEO – Simplifying Energy Post-Trade Workflows: Lifting Schedule in Action: Part of a series of walkthrough videos showcasing how our DT4 solution streamlines critical post-trade processes in energy and beyond, our first video highlights the Lifting Schedule use case – a smarter way to digitally manage lifting plan creation, approval, and distribution.

VIDEO – Simplifying Energy Post-Trade Workflows: Lifting Schedule in Action: Part of a series of walkthrough videos showcasing how our DT4 solution streamlines critical post-trade processes in energy and beyond, our first video highlights the Lifting Schedule use case – a smarter way to digitally manage lifting plan creation, approval, and distribution.

VIDEO – Vessel Nominations Made Simple: Our most recent walkthrough video highlights how DT4 streamlines the Vessel Nomination process, showcasing a digital-first way to manage vetting requests, approvals, and confirmations, reducing manual steps and accelerating workflows for energy companies.

VIDEO – Vessel Nominations Made Simple: Our most recent walkthrough video highlights how DT4 streamlines the Vessel Nomination process, showcasing a digital-first way to manage vetting requests, approvals, and confirmations, reducing manual steps and accelerating workflows for energy companies.

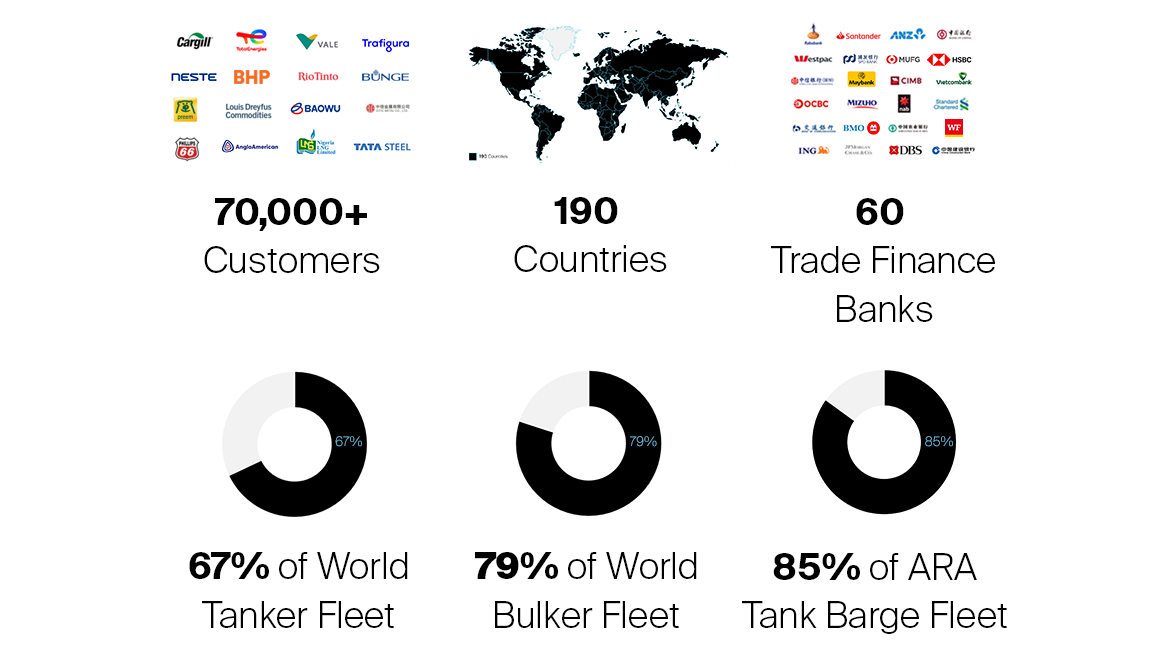

ICE Digital Trade in Numbers